Originally published in The Times of India.

In part 3, Aakarshan Harlalka of AdvanceX and I discuss the business from the vantage point of Zomato’s UX and algorithm. This part of the discussion was the most fun for me because running algorithmic distribution models is my full time job at The Times of India.

On Zomato, revenue is a visibility problem first. The algorithm selects which restaurants show up (candidate list), in which order (ranked list), where across the app (surfaces), and how often (frequency). For operators, the controllable funnel is:

Impressions → Menu Opens → Menu to Order Rate → Average Order Value (AOV).

Everything else—ads, ratings, prep time, delivery promise—rolls up into those four numbers.

To drive organic impressions, be great at positioning, copywriting, photography, and discounts

When a user opens Zomato, the algorithm makes a snap decision: which restaurants even get a shot at the feed. The first cut is positioning. Zomato’s algorithm maps user intent to your basics: cuisine tags, pricing—think “cost for two”—and location signals like distance and delivery time. Nail those inputs and you enter the race. Miss them, and you don’t appear at all. There’s also “leader detection.” For topics like sushi, the system often promotes a canonical choice—reported around 65% of relevant queries—so one option shows first.

Ritvvij’s view: Yes, this is the first step to algorithmic distribution. It is called candidate list generation.

If you make the list, the next battle is the sort order. Two levers matter a lot. Brand affinity—how much demand you retain without ads. And operational hygiene—complaints, rejections, prep speed, uptime, ratings, retention. Reliability moves you up.

Ritvvij’s view: This step is called re-ranking. Likely, Zomato is using a Learning-To-Rank (LTR) model here and optimizing based on material post-click metrics like menu browsing, conversion, and repeat orders instead of vanity metrics like impressions and click-through rates (CTR).

Beyond the feed, Zomato has many surfaces—banners, suggested filters, deal rails, category pages. The more surfaces you index on, the more menu opens you drive.

- That’s where cuisine tags are quiet power. Accurate tags place you on dozens—sometimes hundreds—of daily searches. Bad or missing tags? You’re invisible.

- Discounts don’t just convert buyers—they amplify relevance. For a period, aggressive offers can boost your presence across search and discovery.

Now the craft: copywriting and photography. Clear headlines, scannable descriptions, and appetizing imagery lift menu browsing and conversion—signals the algorithm rewards. The playbook is simple, the execution isn’t. Get the inputs right, tell a crisp story, look great, price smart, and operate efficiently.

Even with great positioning, copywriting, photography, and discounts, smaller restaurants can struggle on organic impressions

Still facing low impressions? Zomato aggregates everything into a “Restaurant Score.” According to 2024 partner guidelines, visibility favors outlets scoring above 4.2 rating, processing orders in under 8 minutes, and keeping cancellations below 3%.

Fall short and visibility can drop by as much as 60%. Attractive branding won’t outrun weak reliability signals. That’s tough for smaller players early on—fewer reviews and leaner ops make it harder to prove reliability at scale.

The algorithm’s logic is performance-first: consistent prep speed, low customer complaints, and good ratings compound your ranking far more than flashy creatives.

Ritvvij’s view: Zomato knows this. To counter incumbency effects, Zomato introduced “Fairness in Ranking” in Q1 FY26—aimed at improving discovery for smaller restaurants during off-peak windows. A diversity injection ensures roughly 15% of top results include restaurants with under 1,000 monthly orders—broadening exposure without blowing up relevance. Reported impact: a 23% order lift for small outlets between 2–5 PM, while maintaining overall platform efficiency.

Ad spends drive ‘menu opens’ on Zomato but lack of transparency on attribution makes it tough to interpret ROI

Across Zomato, majority of menu opens can be attributed to the algorithm and only limited to direct brand search. In fact, many of the top-10 or top-20 feed slots are advertisements, reinforcing paid prominence.

Ritvvij’s view: Top 20? I don’t remember the last when I scrolled beyond it.

Aakarshan continues. Exactly! Even top restaurants see 50–70% of menu opens attributed to advertisements.

- Banners are an advertisement property in Zomato. They are set based on time and season. Think coffee in the morning and vegetarian festival food during Diwali. Restaurants pay a premium to get spotlight here.

- Visit Pack: Restaurants can run campaigns targeted by mealtime, veg or non veg, user type (Less Affluent, Mid Market, Up Market, or All).

- Brand on Search: Restaurants can advertise for specific search keywords, like burgers or burgers Mcd

- Spotlight: Restaurants can run advertisements to get themselves a permanent position for a select duration.

This is fine. If paid is the discovery tax, that’s workable in the unit economics—if you can measure it. The friction begins with attribution opacity.

Click Definition Ambiguity: Advertisement pricing is cost per click—around Rs 14 per click—but definition of what is a click is murky.

- Do repeated taps in one session count as one click or many? What’s a “session”? Time-based or app-state based?

- Attribution windows raise more questions. If someone saw or clicked an ad in the “last 1 day” and orders, it’s attributed to the ad. Is that 24 hours rolling—or calendar day?

Targeting Ambiguity: Restaurants do not know the definition of what classifies a user as Less Affluent, Mid Market, Up Market, or All. Additionally, the definition of veg or non-veg also has not been discussed.

Advertisements In Search: There is also a lack of clarity if search results can get classified as advertisement. For example, if a user has entered ‘Good Fl’ in the search bar and no other restaurant matches this name except ‘Good Flippin’ Burgers’, is a click here an advertisement or organic? The classification isn’t clear. Zomato has also clarified that the below could be an Ad although there is no Ad watermark tagged to it.

The Innovation Paradox: Zomato’s dashboard says that a restaurant received 100 Menu Opens from advertisement campaigns but it does not say how many from search, how many from listing, how many from other avenues? As new advertisement formats ship, measurement complexity rises. Innovation grows inventory, but each layer can add opacity to what’s driving results.

For operators, unclear definitions ripple through unit economics—CAC, payback, contribution margin—making budget planning reactive instead of data-driven. Sustainable ROI needs clear attribution—so operators can invest with confidence, not conjecture.

Scaling impressions to menu opens is all about ratings, delivery time, photos and discounts

Turning impressions into menu opens is a thumbnail, Estimated Delivery Time, Ratings and pricing game. In the split second that matters, the signals dominate: the photo and the discount indicator. Those cues steer attention—and thumbs.

Eye tracking data from e-commerce echoes this: users fixate first on imagery, then price cues. Food discovery follows the same physics.

Platforms know this. Zomato uses machine learning to rotate thumbnails and optimize click-through rates—think contextual bandits testing what image earns the tap.

By default, Chai Point’s thumbnail is chai. Search “paratha” on Zomato, and the thumbnail of the same restaurant pivots to—paratha. Same brand, new visual cue. The platform aligns imagery to the query so you’re more likely to tap what you came for. And yes, even if a spot doesn’t serve “breakfast paratha,” you might see a lunch paratha when you search—intent beats daypart in the image logic.

Ritvvij’s view: Dynamic thumbnailing sounds fun. The model would most likely infer intent, fetch the most relevant dish in menu, and surface its thumbnail because that best represents that intent for this restaurant.

The playbook is clear: photograph your top searched items, upload multiple clean shots, tag precisely, and keep innovating on discounting.

Menu design is all about balancing two trade-offs ‘Menu To Order Rate’ and ‘Average Order Value’

Getting users to the menu is only half the battle. The win is orders—and a higher average order value (AOV) — getting users to spend more.

Start with the obvious: improve the menu’s appeal, improve browsability, images, and descriptions. Browsability reduces friction and lifts add-to-cart. Zomato’s “Menu Score” tracks Appeal, Browsability, and Pricing. It recommends fixes—add photos, trim duplicates, price to reduce post-cart drop-offs—and updates with seasonality. Higher scores correlate with higher menu-to-cart.

Sequence matters. Surface bestsellers early, keep scrollers engaged, and let personalisation reorder by preference, time of day, and past behavior.

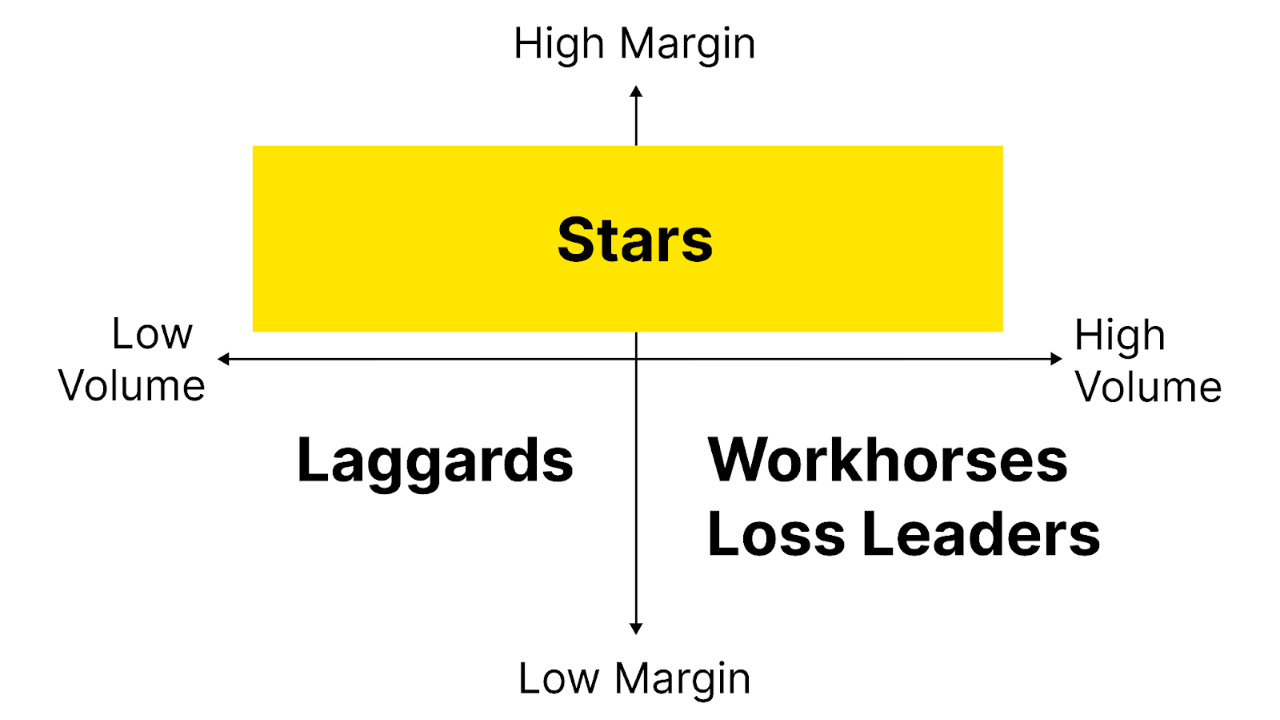

Then comes menu engineering. Bucket every item into four: Stars (high margin), Workhorses (high volume, low margin), and Laggards (low-low). Workhorses could be everyday staples—say, plain dosa or jeera rice—popular but thin margin. Loss leaders? The Rs 99 entry combo that pulls traffic. Bundle these with Stars to protect margins.

Practical play: rank Stars high, package Workhorses and loss leaders inside value combos, give Package stars with appetizing photos and benefits, and quietly retire laggards.

Make photos honest about portion size. Add a spice meter and variant clarity. Less second-guessing equals fewer bounces and more confident upsells.

Price with intent. Small tweaks can slash post-cart drop-offs: round numbers for bundles, sensible gaps between small/large, and visible savings vs à la carte.

To lift AOV, two nudges work reliably: smart combos/upsells and threshold-based free item (say, choco lava cake). Many customers add one more item to cross the free choco lava cake threshold.

Ritvvij’s view: In Q1 FY26, Zomato reported AOV was up 12% year-over-year to Rs 428, driven by a “Smart Bundles” system suggesting complementary items from order history and local tastes. Personalization also speeds decisions—“Recommended” tabs and menu re-ordering reportedly made orders 21% quicker with a +2.5% lift from daily active user to checkout.

The playbook: engineer the menu, not just the branding. Rank what pays, bundle what pulls, clarify choices, and let personalization do the heavy lifting. That’s how a menu open becomes a bigger, faster order.

Conclusion

Tech doesn’t just deliver food — it delivers visibility. Restaurants that master data, automation, and attribution will quietly outrun those chasing discounts.

Want to republish it? This post was released under CC BY-ND — you can republish it as is with the following credit and backlinks: ‘Originally published by Ritvvij Parrikh on The Times of India. The author retains the copyright and any other ancillary rights to the post.

Disclaimer

Views expressed above are the author’s own.

END OF ARTICLE