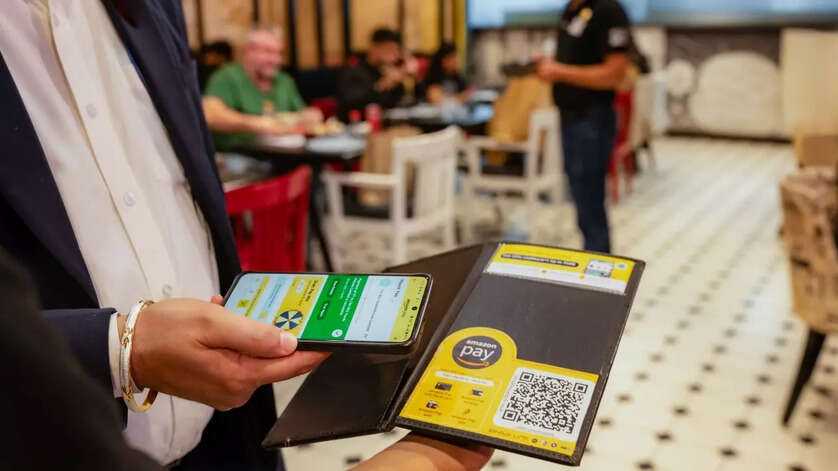

A decade ago, the average Indian consumer viewed digital payments with a mix of curiosity and caution. The primary interaction with online retail was often “Cash on Delivery”, which served as a safety net for a population still testing the waters of the internet. Over time, however, the e-commerce experience has fundamentally rewired this relationship. As platforms began offering a seamless buffet of payment options, from digital wallets and UPI to debit cards and “Buy Now, Pay Later” (BNPL), consumers stopped seeing digital payments as a risk and started seeing them as a convenience.This expansion of offerings did more than just simplify checkout; it democratised access to the formal financial system. By allowing users to toggle effortlessly between a wallet for a small recharge and a credit option for a smartphone, shopping platforms helped millions of Indians become comfortable with a diverse financial toolkit.New industry data confirms that this comfort has transformed into dominant consumer behaviour. Digital payments are no longer an alternative; they are the default. Recent findings note a 35 per cent surge in retail digital transaction volumes in FY25. The preference is staggering, as nearly 90 per cent of respondents now prefer digital modes when making online purchases.These insights come from the How Urban India Pays 2025 report by Kearney and Amazon Pay. The study, which surveyed over 6,000 consumers across 120 cities, highlights a profound shift where habits formed online are dictating offline realities. The report reveals that e-commerce is now a primary catalyst for credit adoption, particularly through co-branded credit cards. These cards have moved beyond niche products to become mass-market tools, with 65 per cent of co-branded cardholders specifically owning a card linked to an e-commerce platform.The launchpad for credit adoptionThis widespread comfort with digital transactions has paved the way for a more significant shift, which is the mainstreaming of formal credit. As e-commerce platforms introduced integrated finance options, they effectively removed the intimidation associated with borrowing.This trend is driven largely by Gen Z and Millennials, who are using these platforms to build their financial profiles. The study reveals a startling statistic where 65 per cent of young professionals applied for a credit card right after starting their first job. For this demographic, credit is not a trap but a strategic tool. While some use it for lifestyle upgrades, a significant portion, 43 per cent to be precise, use credit instruments for financial flexibility and planning.Shashwat Sharma, Partner and Financial Services Lead at Kearney India, notes the significance of this shift. “Gen Z and Millennials are redefining credit adoption in India,” he says, adding, “65 per cent of respondents applied for their first credit card early in their careers. Moving forward, the next big opportunity lies in building trust, personalisation, and inclusive financial products”.Fueling the lifestyle economyAs users graduate from basic payments to credit-led consumption, the nature of spending is also evolving. The report finds that while cash and UPI still rule daily low-ticket expenses, credit instruments are the preferred mode for the aspirational “lifestyle economy”.Consumers are increasingly turning to credit cards and BNPL for high-value categories. The data shows that 19 per cent of respondents use these tools for electronics, while others rely on them for fashion and lifestyle needs. This behaviour extends to leisure as well, with 13 per cent of respondents using credit for hobbies and travel-related expenses. The ability to break large payments into manageable parts or earn rewards on travel bookings has made the digital cart central to the urban Indian lifestyle.Trust travels offlinePerhaps the most powerful outcome of this e-commerce revolution is the “ripple effect” it has created in the physical world. The trust built online is now driving the offline digital economy.The report notes that the preference for digital modes in offline purchases has jumped significantly from 48 per cent in 2024 to 56 per cent in 2025. This suggests that once a consumer becomes comfortable using a wallet or a co-branded card on a shopping app, they are far more likely to use the same tool at a physical store.Vikas Bansal, CEO of Amazon Pay India, emphasises this transition. “The growth in digital payment preference for offline transactions from 48 per cent to 56 per cent in just a year reflects a fundamental shift in consumer behaviour,” he says. “The rising adoption of co-branded credit cards and the strong preference for digital utility bill payments, at 87 per cent, signal a maturing digital payment ecosystem. At Amazon Pay, we are enabling this transition through our comprehensive suite of solutions, making digital payments more rewarding and accessible for all Indians”.As the report concludes, the journey that began with simple online purchases has evolved into a sophisticated financial culture. By offering a safe environment to experiment with UPI, wallets and credit, e-commerce platforms have effectively taught urban India how to master its money.To read the full report, click here.Disclaimer: This article has been produced on behalf of Amazon Pay by Times Internet’s Spotlight team.